building tax-free-wealth with a max-funded-iUL

Indexed Universal Life (IUL) offers compound interest growth, tax-free retirement benefits, and comprehensive family protection. Build wealth and secure your family’s future at the same time.

Learn How It Works

6 Key Benefits of an IUL

Cash Value Growth

Your policy's cash value can multiply through compounding, linked to market index performance, allowing for potentially significant tax-deferred accumulation.

Tax Free Distributions

Access your accumulated cash value in retirement to supplement your income, generally without paying income taxes on all your gains.

Family Protection

Ensure your loved ones are financially secure with a tax-free death benefit if you pass away.

Free Living Benefits

Gain access to a portion of your death benefit while still living if you encounter a qualifying chronic, critical, or terminal illness, often at no additional premium cost.

Loan Options

Borrow against your policy's cash value for any reason, typically tax-free, without impacting the potential indexed interest credited to your account.

Generational Wealth

Efficiently transfer a lasting financial legacy to your beneficiaries, often bypassing probate and income taxes.

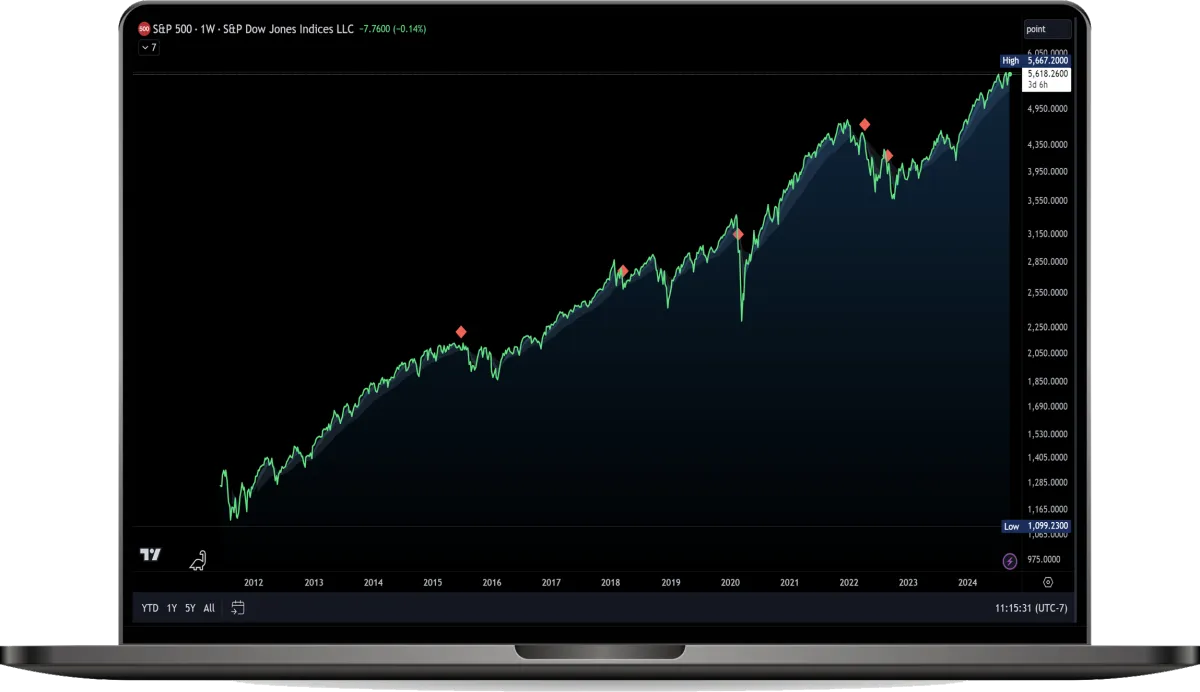

IUL Cash Value Growth

The indexed interest crediting feature of a Max Funded IUL allows policyholders to capitalize on cash value growth linked to stock market indices like the S&P 500. As the index performs well, your cash value accumulates, maximizing your earning potential.

IUL vs 401k

Indexed Universal Life (IUL) offers greater flexibility in premium payments and death benefit options compared to a 401(k). With a Max Funded IUL, policyholders can tailor coverage to meet evolving financial goals. Unlike 401(k) plans, there's no waiting until a specific age to access funds, giving you the freedom to use your money throughout life."

Frequently Asked Questions About Buying an IUL

What’s the first step?

Fill out the form below to see if you pre-qualify. Then speak with a licensed agent to assess your financial goals, risk tolerance, and budget. A good advisor will customize your policy design.

Where can I buy an IUL?

You can buy IULs through licensed independent agents, online insurance marketplaces, or directly from top-rated insurance carriers. CLICK HERE to speak with one.

What are the best IUL carriers?

Some of the highest-rated IUL providers include F&G, NLG & Ethos — but the best depends on your individual needs.

How much do I need to start?

Most carriers allow you to start with as little as $100–$10,000/month. Higher funding unlocks better performance to hit your individual financial goals in life.

Will I need a medical exam?

NO, most carriers offer simplified underwriting or accelerated approval options depending on your current age and health ratings.

IUL better than a IRA or 401k?

An IUL offers unique tax-free benefits and protection features that traditional retirement accounts don’t — but it can also complement to your current retirement strategy.

What to look out for on a IUL

Avoid underfunded policies, carriers with low caps, or agents who don’t explain the moving parts. Proper design and understanding of your individual goals are everything. This is what our agents specialize in.

What Makes This Different

EASE & ACCESSIBILITY

Simplified Process:

From understanding the benefits of a Max Funded IUL to signing up, we make the journey toward securing your financial future straightforward and hassle-free.

Direct Agent Access:

Enjoy the privilege of direct communication with your agent, ensuring personalized attention and responsive support as you navigate your IUL policy.

QUALITY & TRUST

Top-Rated Carriers:

Partnered exclusively with A-rated carriers, ensuring you get the best possible protection with a Max Funded IUL to secure your legacy.

Client-Centric Representation:

At Sura Guard™, your interests are our top priority. We advocate for you, ensuring that your needs and goals are at the forefront when customizing your IUL.

TAILORED PLANS

Listening to You:

Your financial goals and needs are unique, and with a Max Funded IUL, we take the time to listen and understand, ensuring the solutions we provide are perfectly aligned with your aspirations for long-term wealth and security.

Unbiased Recommendations:

With a non-biased approach to product and carrier selection, we ensure you get the best IUL policy tailored to your specific needs, free from pressure or sales tactics.

James P.

"I'm not nervous that I won't have anything put aside for retirement anymore. Thank you Sura Guard"

Tom & Jan - Satisfied Clients

"Sura Guard made the process of getting an IUL easy and understandable. We feel confident about our financial future."

John C - Satisfied Client

"I wish I had discovered the IUL sooner. Thanks for prompting me to take action now rather than never."

Trusted Carrier Ratings

A+ AM Best

A+ S&P Global

A+ Fitch Ratings

A1 Moody's Investors

Step 1:

Pre-Qualify & Get Quote

Obligation-Free

Privacy Policy / Terms & Conditions

"Disclaimer: Sura Guard™ is an insurance marketing agency providing insurance products and connects potential clients with life insurance experts. We receive a fee from our partners for referrals. The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or insurance advice. While we strive to keep the information accurate and up-to-date, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will Sura Guard™ be liable for any loss or damage, including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Through this website, you may be able to link to other websites that are not under the control of Sura Guard™. We have no control over the nature, content, and availability of those sites or agents. This site is for illustration purposes only. Not everyone qualifies | Copyright, All rights reserved Sura Guard™