The Power of

Indexed Universal Life (IUL)

Indexed Universal Life (IUL) policies offer compound interest growth, tax-free retirement benefits, and comprehensive family protection. With this IUL, you can enjoy long-term wealth accumulation and secure your family’s future at the same time.

IUL Key Benefits

Cash Value Growth

Tax-Free Advantages

Higher Returns

No Min Distributions

Death Benefits

Free Living Benefits

Downside Protection

Permanent Coverage

Liquidity Options

Flexible Premiums

Loan Options

Estate Planning

Are you looking for a smarter way to protect your family's future while enjoying compounding market-linked growth with built in downside protection? An Indexed Universal Life (IUL) policy offers a unique blend of financial security and wealth accumulation, making your retirement years even brighter with all these key benefits.

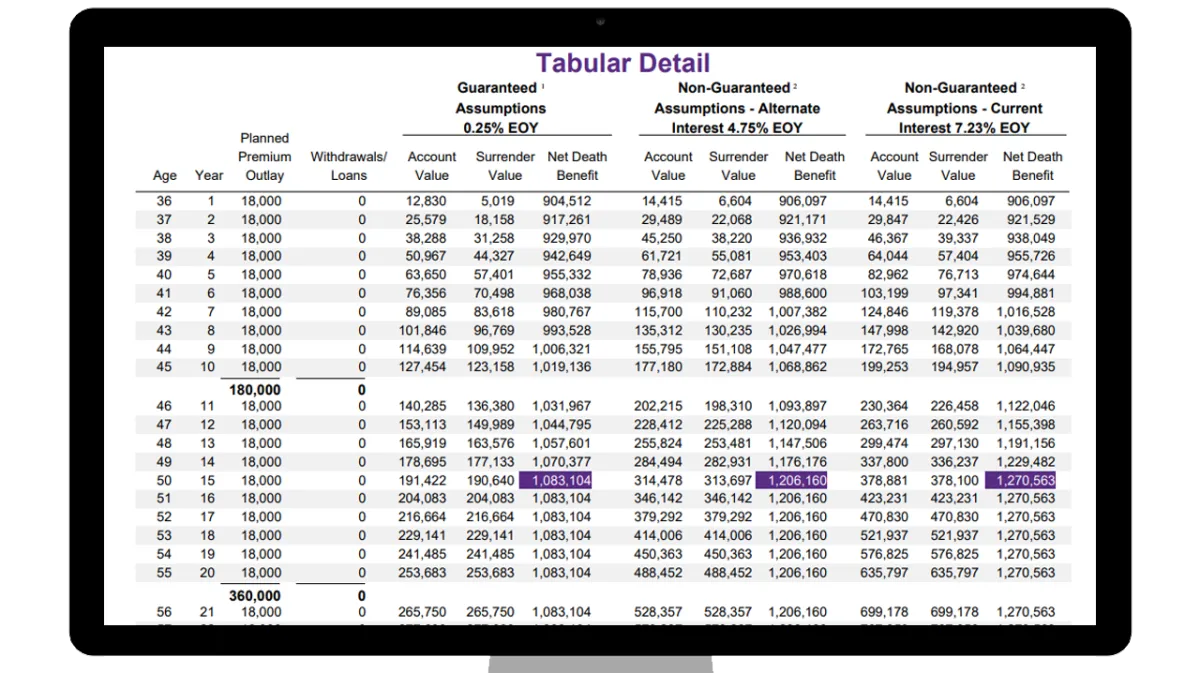

FREE Indexed Universal Life Illustrations

Let one of our licenced professionals run a illustration to show you the numbers. The most challenging part of securing a IUL policy is the approval process. See if you qualify today!

Why do people like Indexed Universal Life (IUL) policies?

IULs allow you to benefit from market gains while limiting downside losses. With a flexible and customizable approach, IULs provide both financial protection for your loved ones and a strategy for building your financial future. This advanced index life insurance policy offers a powerful tax-free retirement solution. We help you find the best IUL for retirement by guiding you to the top index universal life (IUL) companies tailored to your needs.

Why do our clients refer everyone they know?

It’s because we understand that not all Indexed Universal Life (IUL) policies are created equal. There are different ways to structure IULs, and not all carriers offer the same options. We help you find the best IUL product tailored to your personal goals. Most people want maximum cash value accumulation with minimal life insurance, but many agencies don’t ask the right questions and push products that benefit them, not you. Our agents prioritize your needs by delivering more value with a custom-designed index universal life (IUL) policy, always in the best interest of our clients.

Will you qualify for an Indexed Universal Life (IUL) policy?

Finding the best IUL carriers is easy, and we have the resources to help you. The challenge is that not everyone qualifies for an IUL. To get the best IUL account, you need to be in relatively good health and insurable. We guide you through the process of understanding and setting up your personalized index universal life (IUL) policy, helping you get qualified for the coverage you need.

Our Commitment:

We are committed to helping lifelong clients like you make informed decisions about your financial future. Our team of experts is ready to guide you through the process and tailor the perfect Indexed Universal Life (IUL) policy that aligns with your unique goals, ensuring you get the best IUL coverage for long-term wealth and protection."

Frequently Asked Questions About Buying an IUL

What’s the first step to buy an IUL?

Speak with a licensed agent to assess your financial goals, risk tolerance, and budget. A good advisor will customize your policy design.

Where can I buy an IUL?

You can buy IULs through licensed independent agents, online insurance marketplaces, or directly from top-rated insurance carriers. CLICK HERE to speak with one.

What are the best IUL companies?

Some of the highest-rated IUL providers include F&G, NLG & Ethos — but the best depends on your needs.

How much do I need to start an IUL?

Most carriers allow you to start with as little as $50–$5,000/month, but higher funding typically unlocks better performance.

Can I get an IUL with no medical exam?

Yes, some carriers offer simplified underwriting or accelerated approval options depending on your age and health.

Is an IUL better than a Roth IRA or 401(k)?

An IUL offers unique tax-free benefits and protection features that traditional retirement accounts don’t — but it can also complement them.

What should I watch out for when buying an IUL?

Avoid underfunded policies, carriers with low caps, or agents who don’t explain the moving parts. Proper design is everything.

James P.

"I'm not nervous that I won't have anything put aside for retirement anymore. Thank you Sura Guard"

Tom & Jan - Satisfied Clients

"Sura Guard made the process of getting an IUL easy and understandable. We feel confident about our financial future."

John C - Satisfied Client

"I wish I had discovered the IUL sooner. Thanks for prompting me to take action now rather than never."

Do You Qualify?

One of Our Trusted Carriers

A+

Outlook: Stable

AM Best

A+

Outlook: Stable

S&P Global

A+

Outlook: Stable

Fitch Ratings

A1

Outlook: Stable

Moody's Investors

Privacy Policy / Terms & Conditions

"Legal Disclaimer: Sura Guard™ is an insurance agency providing insurance products and services. The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or insurance advice. While we strive to keep the information accurate and up-to-date, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will Sura Guard™ be liable for any loss or damage, including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Through this website, you may be able to link to other websites that are not under the control of Sura Guard™. We have no control over the nature, content, and availability of those sites. This site is for illustration purposes only. Not everyone qualifies | All rights reserved Sura Guard ™