Indexed Universal Life (IUL)

Life insurance with cash value growth

Are you looking for a smarter way to protect your family's future while enjoying compounding market-linked growth? Indexed Universal Life (IUL) offers a unique blend of financial security plus wealth accumulation to make your golden years, a little more golden!

Key Benefits of The IUL

Compounded Cash Value Growth

Tax-Free Advantages

Death Benefits

Free Living Benefits

Liquidity

Flexibility

Free From Probate

NEXgen Wealth

IUL Accelerated Growth

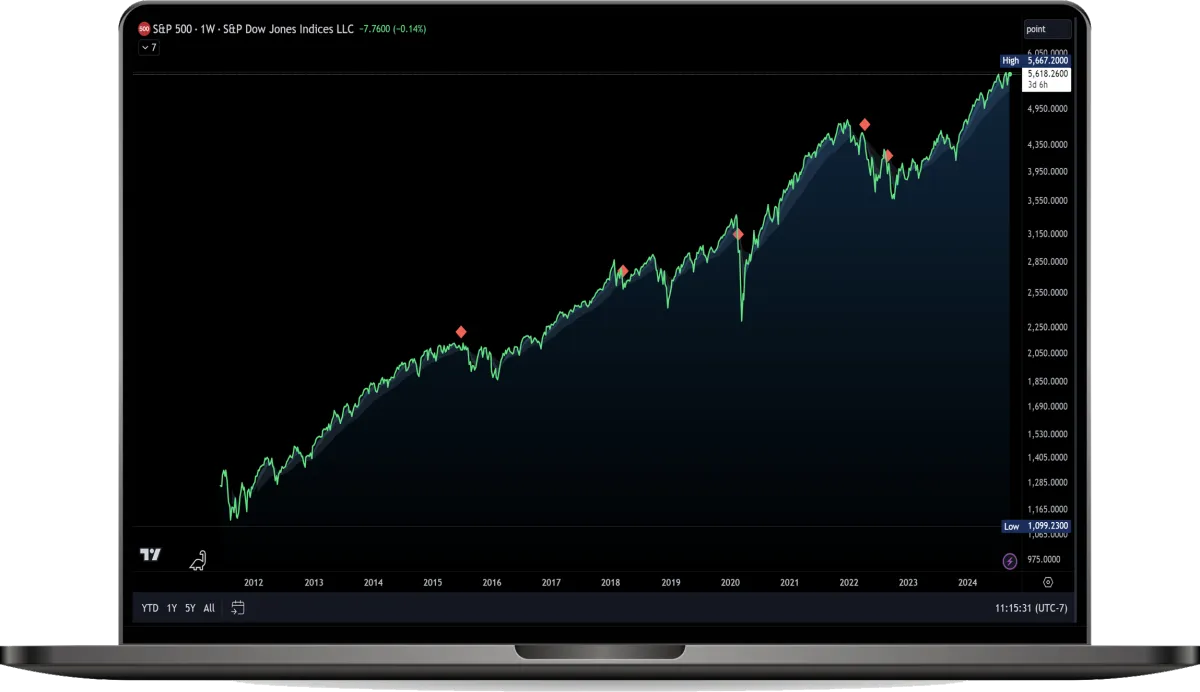

The indexed interest crediting feature of an IUL helps policyholders capitalize on the cash value growth linked to the performance of stock market indices like the S&P 500. As the index thrives, your cash value prospers.

Index Universal Life vs 401k

Index Universal Life (IUL) provides greater flexibility in premium payments and death benefit options compared to a 401(k). With an IUL, policyholders can tailor their coverage to accommodate evolving financial needs and objectives. Unlike 401(k) plans, there's no need to wait until a specific age to access funds, and you have the freedom to use your money without seeking permission.

What Makes Us Different

EASE & ACCESSIBILITY

Simplified Process:

From understanding to signing up, we make the journey toward securing your future straightforward and hassle-free.

Direct Agent Access:

Enjoy the privilege of direct communication with your agent, ensuring personal attention and responsiveness to your needs.

QUALITY & TRUST

Top-Rated Carriers:

We partner exclusively with A-rated carriers, guaranteeing the best possible protection for your legacy.

Client-Centric Representation:

At Sura Guard™, your interests are paramount. We advocate on your behalf, ensuring your needs and goals are front and center in every decision.

TAILORED PLANS

Listening to You:

Your financial goals and needs are unique. We take the time to listen and understand, ensuring the solutions we provide are perfectly aligned with your aspirations.

Unbiased Recommendations:

With a non-biased approach to product and carrier selection, we ensure you get the best fit for your specific needs, without any pressure or sales tactics.

Frequently Asked Questions

How does an IUL work?

IUL is a type of permanent life insurance that provides both a death benefit to your beneficiaries and a cash value component that can grow based on the performance of a specified stock market index, like the S&P 500. Unlike direct investments in the stock market, your cash value has the potential to grow with the market and with a degree of protection against loss. Your premiums are flexible, allowing you to adjust them based on your financial situation.

How to open a IUL account?

Step 1: Fill out the survey below (CLICK HERE)

Step 2: Schedule a intro call with a licensed specialist.

Step 3: Build a custom illustration with a licensed specialist.

Step 4: Fill out application and apply with the carrier.

Step 5: Get approved and make your first premium.

How do you get approved?

Approval for an IUL is just an application process and most of the time exam free underwriting. The approval time can vary depending on the carrier. Some carriers have instant decision while others take 1-4 weeks. We guide our clients through every step to ensure a smooth and efficient process.

What is the minimum you can pay?

The minimum premium for an IUL policy varies by insurance carrier and your specific policy details, including your age, health, and the amount of coverage you're seeking. Generally, there is a minimum amount needed to keep the policy active, which can be discussed during your strategy session with us.

What is the maximum you can pay?

The maximum premium you can pay into an IUL policy is determined by the IRS to ensure that the policy remains classified as life insurance and benefits from tax advantages. Exceeding these limits can turn your policy into a Modified Endowment Contract (MEC), changing its tax treatment. We'll work with you to determine the optimal premium payments to meet your goals without surpassing these limits.

What is max funded?

Max funding your Indexed Universal Life (IUL) insurance policy can provide numerous benefits, including accelerated cash value growth, enhanced death benefit protection for your beneficiaries, tax-advantaged growth, greater flexibility and control over your policy, and alignment with long-term financial planning goals. By contributing the maximum allowable premium payments, you can potentially optimize the performance of your policy, capitalize on market growth opportunities, and build a valuable asset that supports your financial security and legacy planning objectives.

What are living benefits?

If you face a critical, chronic, or terminal illness, you have the option to access portions of your death benefits to help manage your finances during these challenging times. These are complimentary benefits offered by some carriers to enhance the policy's value. However, it's important to note that not everyone qualifies for these free living benefits.

TESTIMONIALS

"I'm not nervous that I won't have anything put aside for retirement anymore. Thank you Sura Guard"

James k - Satisfied Client

"Sura Guard made the process of getting an IUL easy and understandable. We feel confident about our financial future."

Adam & Sarah - Satisfied Clients

"I wish I had discovered IULs sooner. Thanks for prompting me to take action now rather than never."

John B - Satisfied Client

Step 1:

Get More Information

One of our Trusted Carriers

A-

Outlook: Positive

AM Best

A-

Outlook: Stable

S&P Global

A-

Outlook: Stable

Fitch Ratings

A3

Outlook: Stable

Moody's Investors

Privacy Policy / Terms & Conditions

"Disclaimer: Sura Guard™ is an insurance marketing agency providing insurance products and connects potential clients with life insurance experts. We receive a fee from our partners for referrals. The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or insurance advice. While we strive to keep the information accurate and up-to-date, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will Sura Guard™ be liable for any loss or damage, including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Through this website, you may be able to link to other websites that are not under the control of Sura Guard™. We have no control over the nature, content, and availability of those sites or agents. This site is for illustration purposes only. Not everyone qualifies | Copyright, All rights reserved Sura Guard™